Unlocking Cash Flow: How Invoice Factoring Benefits Businesses

Invoice factoring is a financial arrangement that enables businesses to unlock cash flow by selling their accounts receivable to a third-party entity, known as a factor.

This article aims to explore the benefits of invoice factoring for businesses. The first section provides an overview of the basics of invoice factoring, including its definition and key features.

Subsequently, it discusses how invoice factoring can expedite cash flow for business growth, highlighting its potential to provide immediate access to funds.

Furthermore, the article examines how invoice factoring offers flexibility in financial planning and management through its ability to adapt to changing business needs.

Additionally, it explores how this financing method can minimize risk and improve cash flow stability by transferring credit risks associated with unpaid invoices to the factor.

Through an objective analysis of these advantages, this article seeks to inform readers about the potential benefits that businesses can derive from implementing invoice factoring as a strategic financial tool.

Understanding the Basics of Invoice Factoring

The fundamental principles and mechanisms of invoice factoring are essential to comprehend in order to fully grasp the potential benefits it can provide for businesses.

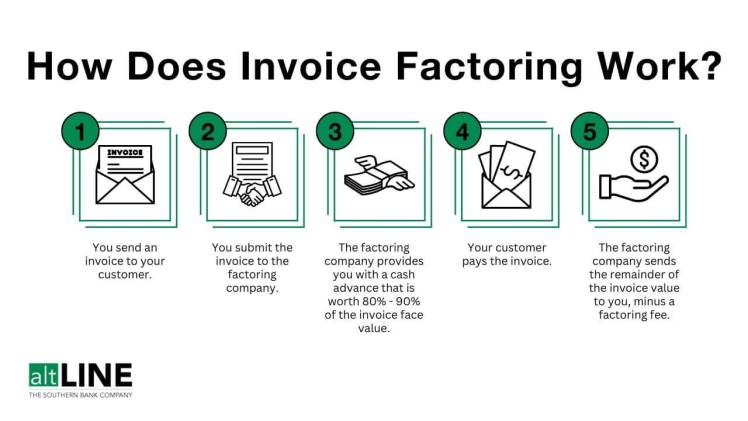

Invoice factoring is a financial arrangement where a business sells its accounts receivable (invoices) to a third-party known as a factor at a discounted price.

This allows the business to receive immediate cash flow instead of waiting for customers to pay their invoices, which can sometimes take weeks or even months.

The factor then takes over the responsibility of collecting payment from the customers.

The discount applied by the factor serves as their fee for providing this service.

This form of financing can be particularly beneficial for businesses that experience cash flow problems due to slow-paying customers or long payment terms, as it provides them with quick access to much-needed working capital.

Expedited Cash Flow for Business Growth

Expedited cash flow enables businesses to experience accelerated growth opportunities. By utilizing invoice factoring, companies can access immediate funds based on their outstanding invoices.

This process involves selling unpaid invoices to a third-party finance company at a discounted rate, allowing the business to receive a significant portion of the invoice amount upfront. The factoring company then assumes responsibility for collecting payment from the customer.

This arrangement provides businesses with a quick injection of working capital, which can be used for various purposes such as investing in new equipment, hiring additional staff, or expanding operations.

With improved cash flow, companies can seize growth opportunities that may otherwise be hindered by limited financial resources. Furthermore, by outsourcing credit management and collections to the factoring company, businesses can focus on core activities and efficiently allocate resources for growth.

Flexibility in Financial Planning and Management

Flexibility in financial planning and management allows businesses to adapt and adjust their strategies according to changing market conditions and emerging opportunities. This flexibility provides numerous benefits that can contribute to the success of a business.

Increased agility: By having flexible financial plans, businesses can quickly respond to market fluctuations or unexpected events, enabling them to stay ahead of their competitors.

Improved risk management: Flexibility in financial planning allows businesses to allocate resources effectively, reducing the potential impact of financial risks.

Enhanced decision-making: With the ability to modify financial plans as needed, businesses can make informed decisions based on up-to-date information and analysis.

Optimal resource utilization: Flexible financial planning enables businesses to allocate resources efficiently, ensuring that they are utilized where they are most needed.

Overall, flexibility in financial planning and management is crucial for businesses aiming to thrive in today’s dynamic and competitive markets.

Minimizing Risk and Improving Cash Flow Stability

Minimizing risk and improving cash flow stability requires careful financial planning and effective management strategies. One way to achieve these goals is through invoice factoring, a financing method that allows businesses to sell their accounts receivable to a third-party factor in exchange for immediate cash.

By utilizing this strategy, companies can reduce the risk of nonpayment from customers and ensure a steady stream of working capital. Invoice factoring provides businesses with the flexibility to access funds quickly without having to wait for payment on outstanding invoices. This eliminates the need for additional debt or borrowing, minimizing the financial strain on the company.

Furthermore, by outsourcing credit checks and collections to the factor, businesses can focus on core operations while reducing administrative costs associated with managing accounts receivable.

Overall, invoice factoring offers an effective solution for minimizing risk and improving cash flow stability in business operations.

Conclusion

In conclusion, invoice factoring is a valuable financial tool for businesses to unlock their cash flow potential. By leveraging unpaid invoices, businesses can access expedited cash flow, fueling their growth and expansion plans.

Additionally, invoice factoring provides flexibility in financial planning and management, allowing businesses to allocate funds strategically.

Moreover, it helps minimize risk by transferring the burden of non-payment to the factoring company while improving cash flow stability.

Overall, invoice factoring offers numerous benefits that can significantly enhance a business’s financial health and success.