Steering Your Business Toward Stability: Strategies for Financial Success

Achieving ongoing financial stability represents a pivotal yet often elusive goal for companies seeking prosperity. Volatile markets, changing consumer preferences, and unforeseen events can quickly jeopardize stability. However, with prudent strategies around cash flow management, planning, and leveraging solutions like AR factoring accounting, businesses can take control of their financial trajectory.

By conducting objective assessments, optimizing budgets, harnessing technology, and seeking expert guidance, companies steer toward resilience. Stability enables confidently pursuing innovation and strategic growth through both calm and turbulent times. A proactive, hands-on approach to finances lays the foundation for enterprises to thrive well into the future.

Assessing Your Business’s Financial Health

An accurate evaluation of current financial status allows creating tailored strategies to perform ratio analysis on liquidity, debt levels, profitability, returns, and other indicators to identify vulnerabilities. It also lets you review systems for gaps affecting accuracy, like poor invoicing or stock management. Precise data enables decisions. You can also benchmark against competitors and industry standards to determine areas of underperformance.

Assessments illuminate strengths to leverage and weaknesses to address. An honest evaluation clarifies the path forward.

The Role of Cash Flow in Business Stability

Managing cash flow represents a key factor in balancing financial stability. Cash flow issues like late customer payments or seasonal dips easily trigger wider problems if reserves are inadequate. Maintaining smooth operations requires liquidity. As well as this, delayed or unpredictable cash inflows strain the ability to cover fixed costs like payroll, rent, supplies. Volatility leads to haphazard decisions. The experts at Thales Financial say that AR factoring accounting can address fluctuations by providing flexible working capital linked directly to unpaid sales invoices. This aligns liquidity with revenue.

Monitoring and optimizing cash flow dynamics provides buffer room for stability during market swings. Factoring strengthens resilience.

What is AR Factoring Accounting?

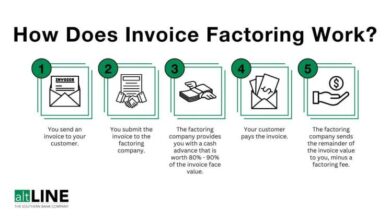

AR factoring accounting allows businesses to convert outstanding invoice value into immediate cash. It involves selling unpaid customer invoices to a commercial finance company to obtain working capital, rather than waiting for customers to remit payments. The funding company purchases the invoices at a discount in exchange for upfront payment, thereby improving short-term cash flow for the business. Factoring accelerates liquidity, outsources collections, and offloads credit risk associated with invoices.

Leveraging AR Factoring for Improved Cash Flow

Thoughtfully implemented AR factoring accounting provides cash flow advantages in a few ways. First, providing instant access to capital from unpaid sales invoices to fund operations and growth. No waiting for customers. Then, reducing staff workload by outsourcing collections and payment follow-ups to the factoring company. Finally, stabilizing cash flow by aligning working capital to actual sales. Factoring matches liquidity to revenue cycles.

Choosing the Right AR Factoring Company

Selecting the optimal factoring partner involves due diligence. Vet several providers on reputation, transparency around rates/fees, and customer service, and avoid vague or evasive firms. Analyze the true total costs like factor rates, transaction charges, and termination clauses to determine ROI. You can then choose specialists with offerings tailored for your industry rather than a one-size-fits-all approach.

Best Practices for AR Factoring Implementation

Follow protocols to effectively leverage factoring. Do this by identifying high value invoices with reliable customers for routine factoring based on needs. Avoid haphazard selection. Also maintain meticulous records of invoices, shipments, and payments to streamline factoring. Sloppy documentation raises costs. You also need to communicate clearly with customers around accounts receivable factoring processes to avoid confusion and delays paying invoices.

With strategic processes, AR factoring seamlessly aligns with business objectives as a stability tool.

Conclusion

Actively monitoring financial health, optimizing cash management, and leveraging AR factoring accounting enables enterprises to take charge of their stability. A proactive approach with both prudence and creativity keeps companies on course through market volatility. With financial security, businesses steer confidently towards strategic goals and sustained success.