Parent Loans For College: Financing Your Child’s Education

As parents, the journey of raising a child comes with its fair share of joys and challenges. One such challenge is ensuring that your child receives the best possible education. However, with the rising costs of college tuition, financing your child’s education can often feel like navigating through rough waters.

But fear not! There is a lifeline available in the form of parent loans for college. These loans provide parents with an opportunity to support their child’s educational dreams without breaking the bank.

In this article, we will dive into understanding the cost of college education, exploring federal loan options, considering private loan alternatives, and weighing the pros and cons of parent loans.

Additionally, we will provide tips for managing these loans effectively so that you can confidently embark on this financial journey alongside your child. So grab your life vest and let’s set sail towards a brighter future for your family!

Understanding the Cost of College Education

Understanding the cost of college education is a crucial step in determining how to best finance your child’s future academic endeavors. It is important for parents to have a clear understanding of the expenses associated with college, such as tuition fees, textbooks, room and board, and other miscellaneous costs.

These expenses can vary significantly depending on whether your child attends a public or private institution, in-state or out-of-state, and whether they live on campus or commute.

In addition to these direct costs, there are also indirect expenses to consider, including transportation, personal expenses, and potential increases in the cost of living during their time at college. By understanding these costs upfront, parents can better plan for how much they will need to budget and potentially save or borrow in order to provide their child with a quality education.

For parents considering parent loans for college financing options, it is essential to be aware of trends and plan accordingly. Overall, having a comprehensive understanding of the cost of college education is vital for parents when making decisions about financing their child’s higher education journey.

Exploring Federal Loan Options

Did you know that over 92% of students who apply for federal loans receive some form of financial aid?

Federal loans are a popular option for parents looking to finance their child’s college education. These loans are provided by the government and offer several benefits, such as fixed interest rates and flexible repayment options.

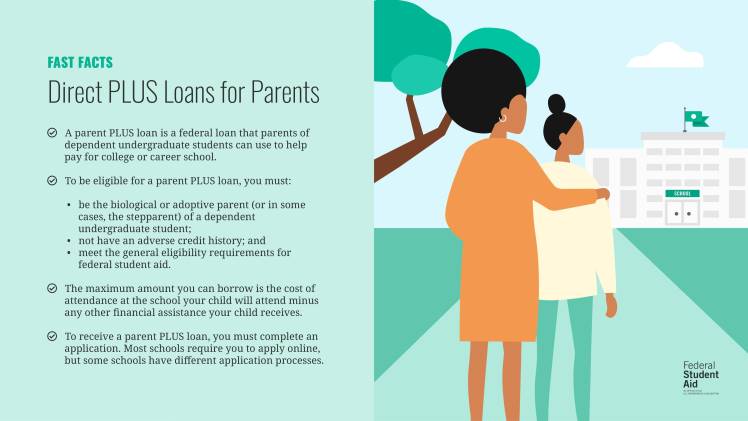

One type of federal loan is the Direct PLUS Loan, available to graduate or professional degree students, as well as parents of dependent undergraduate students. This loan allows parents to borrow up to the full cost of attendance minus any other financial aid received. Another option is the Direct Subsidized Loan, which is based on financial need and offers lower interest rates compared to other types of loans. Overall, exploring federal loan options can help parents make informed decisions about financing their child’s education.

Considering Private Loan Alternatives

When it comes to funding your child’s education, have you considered exploring private loan alternatives?

While federal loans can be a great option, private loans also offer some advantages. Private loans often have higher borrowing limits, allowing parents to cover the full cost of tuition and other expenses. Additionally, private lenders may offer more flexible repayment options, such as interest-only payments while your child is in school. However, it’s important to carefully consider the terms and conditions of private loans before committing.

Interest rates on private loans can vary widely and may be higher than those offered by federal programs. It’s also worth noting that private loans do not offer the same borrower protections as federal loans, such as income-driven repayment plans or loan forgiveness options. Before deciding on a loan option, it’s wise to compare offers from multiple lenders and carefully weigh the pros and cons of each alternative.

Weighing the Pros and Cons of Parent Loans

Considering the pros and cons of taking out a loan to fund your child’s education is like weighing the benefits and drawbacks of a high-stakes investment.

On one hand, parent loans can provide immediate financial relief, allowing parents to cover the costs of tuition, room and board, and other expenses. This can enable their children to attend their desired college or university without having to worry about affordability. Additionally, parent loans often have lower interest rates compared to private student loans, saving families money in the long run.

However, there are also downsides to parent loans. One major drawback is that parents may be burdened with debt well into their retirement years. This can impact their ability to save for other financial goals such as buying a home or funding their own retirement. Furthermore, if parents are unable to make timely payments on the loan, it could negatively affect their credit score.

Ultimately, deciding whether or not to take out a parent loan requires careful consideration of both the potential benefits and risks involved. Parents should weigh these factors against their own financial situation and long-term goals before making a decision.

Tips for Managing Parent Loans Effectively

Managing parent loans effectively is crucial for long-term financial stability and achieving future goals. Here are some tips to help parents effectively manage their loans:

- Have a clear understanding of loan terms and repayment options. Review interest rates, monthly payments, and any potential fees associated with the loan.

- Create a budget that includes loan repayment alongside other financial obligations.

- Make regular, on-time payments to avoid penalties or additional interest charges.

- Explore options for refinancing or consolidating parent loans to lower monthly payments or interest rates.

- Seek professional advice from financial planners or student loan counselors for guidance on managing parent loans effectively and maximizing available resources.

Conclusion

In conclusion, financing your child’s college education through parent loans can be a daunting task. However, with careful consideration of federal loan options and private loan alternatives, parents can effectively manage the costs. It is important to weigh the pros and cons of these loans before making a decision. Remember to stay informed about interest rates and repayment plans to avoid any future surprises.

With proper planning and persistence, parents can successfully support their child’s educational journey while keeping their own financial well-being in mind. So go ahead and ace those parent loans like a boss!