Offshore Banking in Castries: How Foreign Investors Can Get Started

St Lucia, with its favorable tax regime and investor-friendly policies, is an attractive destination for offshore banking. Castries, as the financial capital, plays a pivotal role in this sector, offering a range of banking services tailored to the needs of international clients.

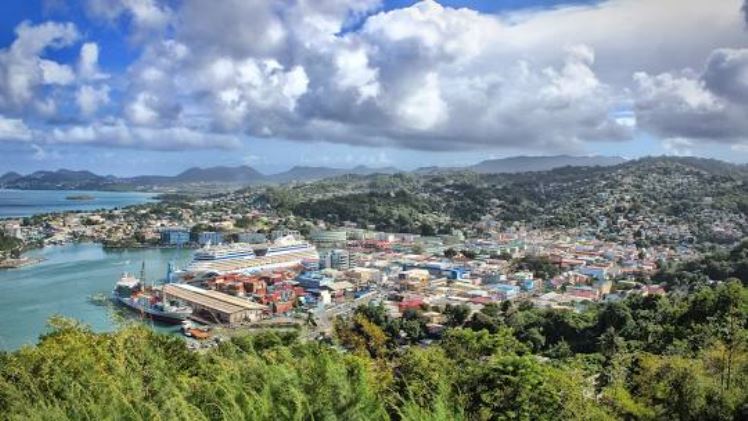

The picturesque city of Castries, the capital of St Lucia, not only boasts stunning Caribbean vistas but also serves as a vital hub for offshore banking. For foreign investors, understanding the nuances of offshore banking in this region is key to unlocking a world of financial opportunities.

Offshore Banking in St Lucia

Offshore banking in St Lucia offers numerous advantages, including tax efficiency, asset protection, and financial privacy. The island’s stable economic and political climate further enhances its attractiveness as an offshore banking destination.

St Lucia’s legal framework is designed to support and facilitate offshore banking activities, making it a favorable environment for foreign investors and business entities looking to establish a financial base in the Caribbean.

Castries: The Financial Capital of St Lucia

Castries is not just the administrative heart of St Lucia but also its financial center. The city hosts a concentration of banks in St Lucia, making it the primary location for conducting offshore banking transactions.

With its well-developed banking infrastructure, Castries provides both convenience and accessibility for foreign investors. The city’s modern banking facilities are equipped to handle a variety of international financial transactions efficiently.

Popular Banks in Castries

Several notable banks in St Lucia, based in Castries, offer offshore banking services. These include:

- Bank of Saint Lucia International Limited: Known for its comprehensive range of offshore banking services.

- FirstCaribbean International Bank: Offers a wide array of services tailored for international clients.

- Scotiabank: A well-established bank providing diverse offshore banking options.

These banks offer services including multi-currency accounts, international wire transfers, online banking, and investment services, all designed to cater to the unique requirements of foreign investors.

How to Open a Bank Account in Castries

- Choose a Bank: Select a bank that aligns with your financial needs and offers suitable offshore services.

- Prepare Documentation: Typically required documents include a valid passport, proof of address, and financial references.

- Complete the Application: The process can often be initiated online, followed by in-person verification.

- Compliance Procedures: Be prepared for due diligence checks in accordance with international financial regulations.

Conclusion

Setting up an offshore bank account in Castries, St Lucia, offers foreign investors a gateway to a host of financial benefits. The combination of St Lucia’s favorable tax policies, the range of services provided by banks in Castries, and the straightforward account opening process make it an appealing choice for those seeking to expand their financial horizons in the Caribbean. With the right approach and understanding of the local banking landscape, foreign investors can efficiently navigate the offshore banking scene in Castries.